Payroll

Definitive Payroll Solutions for Your Business

Faster, Easier payroll that help improve compliance and employee morale

As you know, “Payroll” is the total amount of money that a company pays to its employees. It also refers to company’s records of its employees’ salaries, wages, bonuses and withheld taxes. We, at Links Accounting have extensive knowledge in accounting and finances to manage the payroll of your company. When you are running a business, whether start up or established, payroll plays a major role in the company for several reasons. From accounting prospect, payroll is crucial because payroll and payroll taxes considerably affect the net income of most companies. From human resources perspective, payroll is critical because employees are sensitive to payroll errors and irregularities. Also, good employee morale requires payroll to be paid timely and appropriately. Effective payroll can help you with issues and penalties from CRA - Canada Revenue Agency.

We have expertise in employment-related tax and compliance matters. Our outstanding payroll solutions will help manage your business’ cash-flow and compliance with CRA in a more professional way.

Faster, Easier payroll that help improve compliance and employee morale

As you know, “Payroll” is the total amount of money that a company pays to its employees. It also refers to company’s records of its employees’ salaries, wages, bonuses and withheld taxes. We, at Links Accounting have extensive knowledge in accounting and finances to manage the payroll of your company. When you are running a business, whether start up or established, payroll plays a major role in the company for several reasons. From accounting prospect, payroll is crucial because payroll and payroll taxes considerably affect the net income of most companies. From human resources perspective, payroll is critical because employees are sensitive to payroll errors and irregularities. Also, good employee morale requires payroll to be paid timely and appropriately. Effective payroll can help you with issues and penalties from CRA - Canada Revenue Agency.

We have expertise in employment-related tax and compliance matters. Our outstanding payroll solutions will help manage your business’ cash-flow and compliance with CRA in a more professional way.

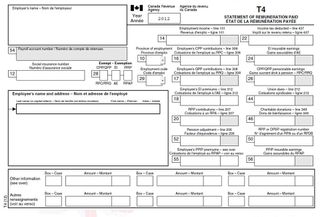

T4 Slip & T4 Summary

T4 slip document lists the total amount of money that was paid to the employee and also the total sum that was withheld on their behalf and remitted to the CRA. It simultaneously allows an employee to complete their tax return

and allows the CRA to know how much money they received and should have paid. In short, it offers a neat summary of the employee’s life at the company for the year, and makes sure that both the employee and the CRA are on the same page for when it comes to tax filing time. At Links Accounting we can help you with preparation of T4 Slip & T4 Summaries.

T4A Slip & T4A Summaries

The T4A is generally used in a lot of edge-cases. Most employees won’t receive T4As, this will vary from industry to industry. Generally, you issue a T4A, if you pay any of the following types of income- pension & superannuation, self-employed commissions, lump sum payments, annuities etc. However, not only it is a requirement to issue T4As when necessary, the CRA has indicated that they will look at T4As more closely during their payroll audits. At Links Accounting we can help you with preparation of T4A Slip & T4A Summaries.

T5 Slip & T5 Summaries

A T5 indicates the total sum of investment income you earned for a given tax year. The income includes most dividends, royalties, and interest from bank accounts, accounts with investment dealers or brokers, insurance policies, annuities and bonds. The Government of Canada has a specific calculation that it attaches to dividends received. This is the amount that is inputted into your T1 personal income tax return. Let Links Accounting help you with preparation of T5 Slip & T5 Summaries.

T5008 Slip & T5008 Summaries

T5008 slip is used to report one transaction or more than one transaction involving identical securities for the same client, you made for a person. There are three slips printed on each T5008 sheet. These are intended to be used for laser or ink jet printers, for typing, or to be filled out by hand. Every trader or dealer in securities who buys a security as principal or sells a security as an agent needs to prepare a T5008 slip. Also, the individuals involved in the business of buying and selling precious metals also need to pay a T5008 slip. Let Links Accounting help you with preparation of T5008 Slip & T5008 Summaries.

T5018

A T5018 is an information slip that is provided to the contractor and to CRA for information purposes only. The information indicated on the T5018 slip is used by CRA in a number of ways. First, it is matched with tax returns for that year to ensure that the subcontractor filed a tax return and declared the amounts listed in the T5018, plus amounts listed in any other information slips received by that subcontractor. This information is also used for identification, compliance, audit programs, and statistical purposes.

Contact Links Accounting today and let us help you with all your payroll needs.